Demystifying employee incentive schemes

January 3, 2023

In this month's xCollective we’re discussing an exciting subject! Well, exciting for some, less for others. Nevertheless, a topic that occupies the minds of many founders. We’re going to talk about employee incentive plans and the different approaches you can take. Or the big five, as our guest Bas Jorissen, founding partner at Archipel Tax Advice, likes to call them.

“Apart from just a guy. I am a tax guy.”

Almost 5 years ago, Bas started Archipel Tax Advice, a tax advisory firm that helps the translation between real life and taxation. Their clients – fast-growing corporates & scale-ups – are typically more-than-profit driven, ahead of the curve on technologies or methods, and generally up for using a little imagination in getting things done.

Bas starts off by saying, “Tax law is intended to serve the greater good, but it has become extremely complex. Although, it can be a good news show if you choose to address it as such. So that's my motivator.” Besides that, he adds, “the people I can sit at the table with, they’re usually much more interesting than myself, and that's always good. Surprisingly, as a tax guy, I actually get to sit at those tables. Because tax is not complex, it's just obscure. And I took the time to dive in.”

The importance of employee incentives schemes

As a ‘tax guy’ Bas is a big fan of employee incentives schemes, and not only because the tax side of it is fascinating. He believes that these types of incentives help companies perform better. “Employee incentive schemes help with employee retention and motivation, and that’s not just my word. Research of the Harvard Business Review shows, companies perform a third better after implementing incentive plans perform than before.” Bas shares.

The only thing against it, he shares, “The set-up can be complex. I see many founders struggling with how to approach employee incentive schemes. There’s a lot of unclarity around the subject, and that's where we come in.”

The big 5 employee incentive schemes

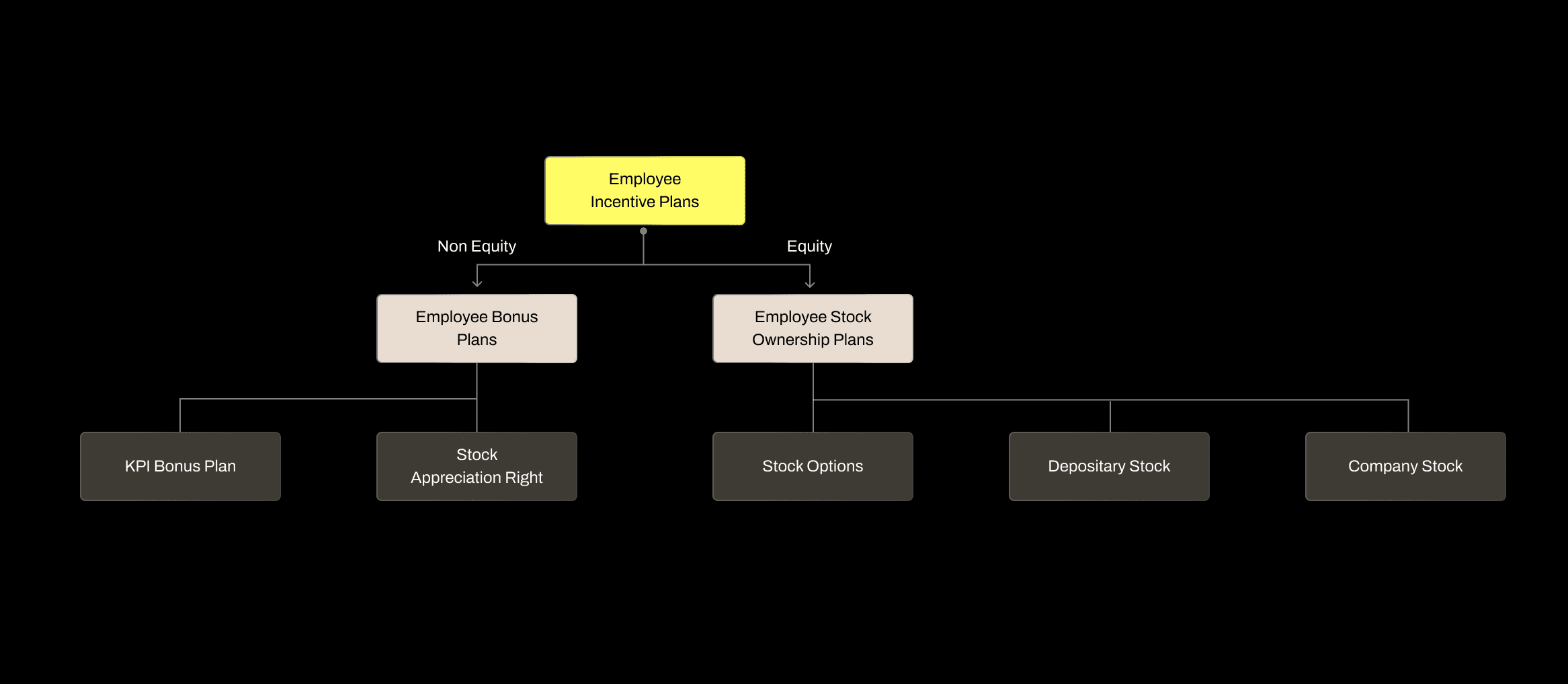

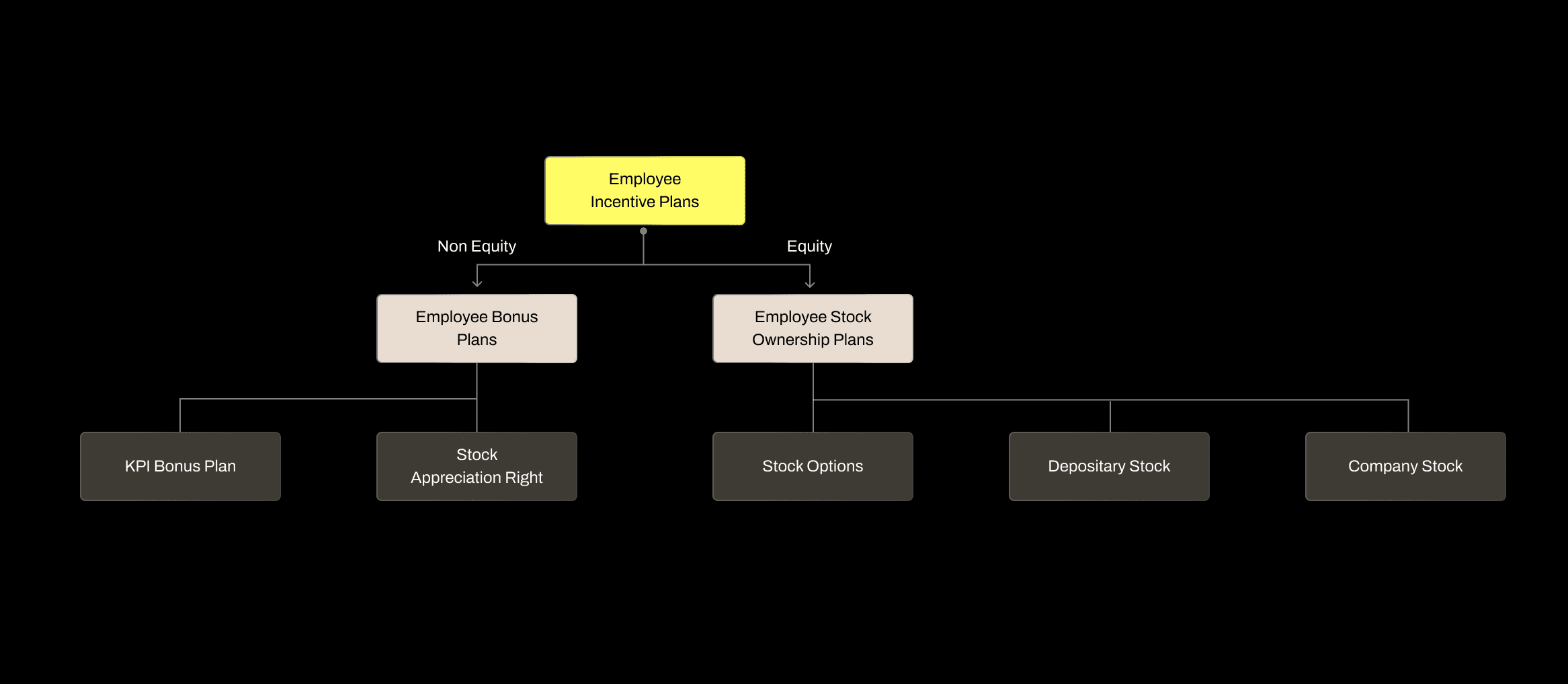

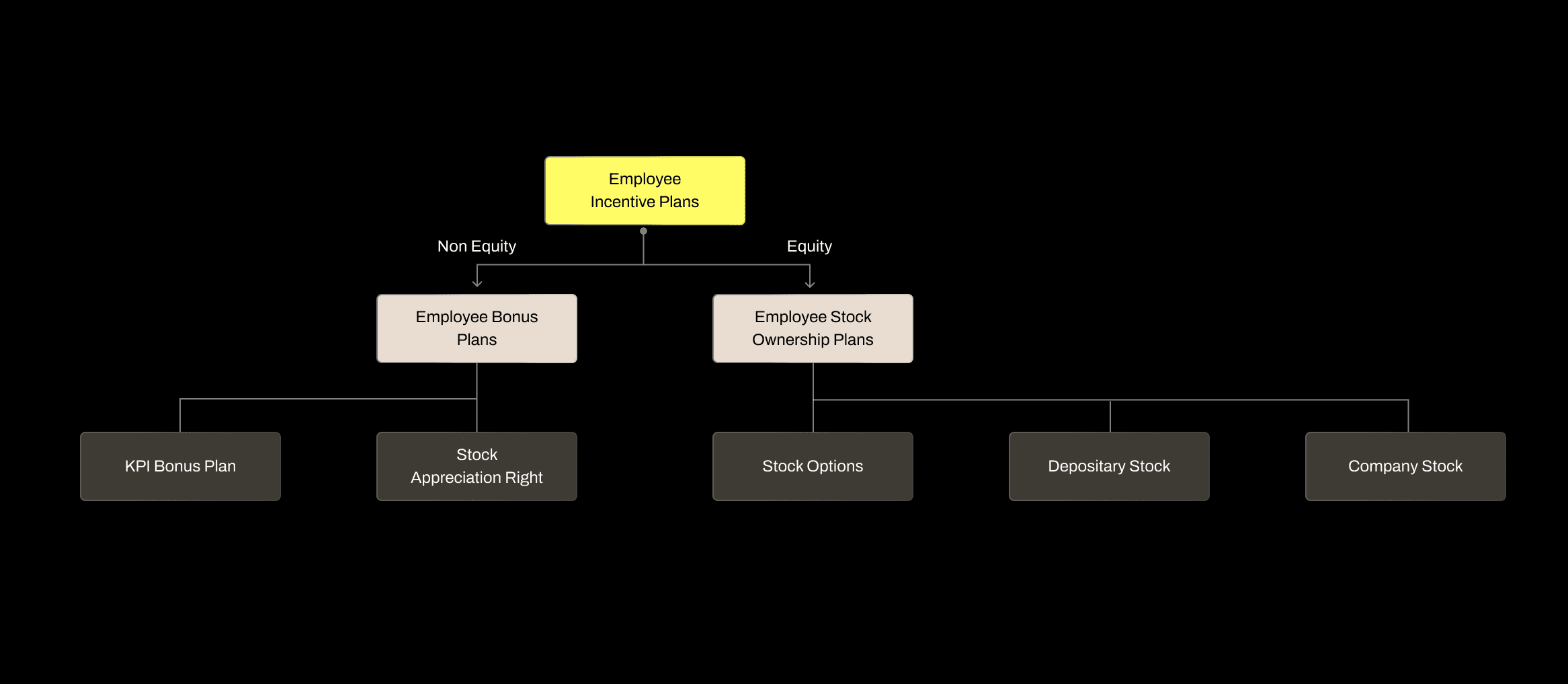

As already spilled in the intro, when Bas talks about the big 5 he’s talking about the 5 different employee incentive schemes. Bas sees this as a ‘genome tree’, like you'd find in a zoology book. Under the big umbrella of incentive plans, there are two main subcategories: non equity based plans and equity based plans.

Non equity based plans

Non equity based plans, also called employee bonus plans, typically reward employees with cash rather than company stock. There are two different types of non equity based plans.

The first and most common incentive plan is the Key Performance Indicator (KPI) plan, where employees get rewarded with an additional cash payment when specific personal goals or KPIs are met. A rather individualistic approach, focussing mostly on the performance of the individual, not necessarily on the company' growth as a whole. A company downside can be that if such an individual milestone is hit, the bonus becomes payable per law while it doesn't automatically link to company cash position. So: maybe the cash isn't there, but the bonus is due…

The second non-equity plan is a virtual stock, also known as Stock Appreciation Right (SAR). SARs are linked to the company's stock price during a fixed period, and are profitable for employees when the company's stock price rises, similar to employee stock options. However, the benefit of stock appreciation rights are that employees can receive proceeds from stock price increases without having to buy stock.

Looking at the pro’s and con’s for non equity based plans, Bas points out that although these plans are super easy to implement, there is a downside. “From a tax perspective, this is not the friendliest regime! Because both of these plans are implemented through the employment contract and are on top of employment wage. Meaning an employee gets extra wage. And wage isn't tax super friendly, the Dutch top rate is 49.5%.”

Equity-based plans

This is where it becomes interesting, according to Bas. “Equity-based plans are complex, because you give actual stock away. It even involves a notary, as it’s not linked to the employment contract, and delves into a whole separate part of law.” Equity-based plans, in other words employee stock ownership plans (ESOPs), give employees shareholder interests, offering them to feel a sense of ownership. These come in threefold: stock options, depositary stock and company stock.

Stock options give the employee the right to buy underlying stocks at a predetermined price within a specific period of time.

Depository shares, also known as share certificates, are issued by a shareholder and grant the depositary owner all the economic rights whilst the legal rights remain with the shareholder. Bas explains that you effectively disconnect the cap table and control table. “The employees are on the cap table, but not on the control table. All the voting and meeting rights related to the underlying shares held by the employee are held by a foundation or trust.”

And finally, actual Company Stock, or as Bas calls it ‘The Ultimate Long Term Thing’. An employee with company stock receives full co-ownership of the company’s equity, is asked to attend the shareholder meetings and allowed to use its voting rights. Usually, this form of equity based incentives is only available to the management team and co-founders.

When asking Bas about the pro’s and cons of these three plans, he starts by sharing, “It’s important to understand that some people don’t really care for this approach. It’s not just about the money now, it’s about having a say and a feeling of ownership. Because you can’t pay your groceries with stocks, right?”

Besides that, it’s way more complex to implement, if you look at the tax side of equity plans. An equity-based plan has two main chapters: the grant or transfer, and the subsequent holding period. Holding equity is generally very tax friendly, as the proceeds are taxed under the capital gains regime. The rate here is much lower at a flat 31%, and the return is a deemed one rather than an actual one. That means the tax due is effectively flat, and especially when the company shows drastic growth, the effective rate can be very favourable. But: the preceding chapter is actually getting the equity to the employee, and that can be complicated. Any implicit or explicit discount granted on the equity transaction is itself taxed as wage, which is taxable at the 49.5% rate. This either means a big cash-out for the company through a gross-up wage tax, or with a tax push-down clause, for the employee getting the stock but needing to pay cash tax. Therefore, the transaction chapter often needs some design to avoid a discount upfront, such as a purchase price loan or a hurdle. It’s been done many times before, so you always figure it out and if you believe in long-term growth, the investment in such a plan is always rational. But implementing equity-based plans isn’t nearly as simple as implementing a bonus wage plan.

If you’re curious about more pros and cons regarding, check out this article that Bas wrote a little while back.

The Netherlands needs to become more equity incentive plan friendly

Bas explains that the complexity around the tax side of equity plan, involves more than just employees and scale-ups. “We’re a high wage, low resource country. Our government policy is geared towards being an exporter of intellectual property, the knowledge economy. And the shortage of highly educated people is a big bottleneck for the Dutch economy. Something a lot of companies overcome by raising salaries or bonuses. But sadly, most scale-ups just don’t have the cash to give their employees a higher salary or a bonus.”

The reason, the whole scale-up industry, is lobbying for the Netherlands to become a bit more equity incentive plan friendly. “But until that moment, this is what we have to work with. And we always make it work” Bas adds.

Final piece of advice

If we haven’t scared you off, hopefully we didn’t, because employee incentive plans are a great way to increase your employee's contentment and your company performance. For those companies that are at the beginning of setting up their employee incentive plans, Bas has a few valuable steps:

What type of incentives would employees value the most?

Start by asking your employees what type of incentives they value the most, what would incentivize them? Cash? Ownership?

What are you willing to give away?

After finding out what your employees value the most, it’s good to think about what you are willing to give away. This might already eliminate a few options your employees gave you.

Forecast the cash flow and see is feasible

As explained earlier, it’s important to take a close look at your cash flow. For instance, if you would set up a non-equity based plan. You need to realise that when a milestone is hit, and the bonus becomes payable per law, it doesn't automatically link to your company cash position. Maybe the cash isn't there, but the bonus is due. So forecasting cashflows [simpler than it sounds] usually narrows it down further.

Compare the different options by making scenarios

Eventually, compare the different options that are still left, to decide which of those would work best for your situation. Give it some time to simmer, think up scenario’s, and see if you’re happy.

Make a thorough decision, you can only do it once

Compare the different options and set scenarios to find out what would work best – then implement and stick with it.

Always be open and visualise it

Last but not the least Bas mentions “The psychological effect of a raise, according to science, is only two weeks. Not even until the next pay check. Let’s say, if you’d give your employees stock appreciation rights, it takes a considerable amount of time to eventually cash out. If you don’t visualise that this person is hypothetically generating bonus potential, they will not know what they’re doing it for. And that really mitigates the aspect of incentive plans. By dashboarding the incentive plan, it is repeatedly visible, which makes a huge difference for its impact. Big tip!”

Want to learn more about Archipel Tax Advise’s journey and employee incentive plans? Listen to the full story on Spotify.

In this month's xCollective we’re discussing an exciting subject! Well, exciting for some, less for others. Nevertheless, a topic that occupies the minds of many founders. We’re going to talk about employee incentive plans and the different approaches you can take. Or the big five, as our guest Bas Jorissen, founding partner at Archipel Tax Advice, likes to call them.

“Apart from just a guy. I am a tax guy.”

Almost 5 years ago, Bas started Archipel Tax Advice, a tax advisory firm that helps the translation between real life and taxation. Their clients – fast-growing corporates & scale-ups – are typically more-than-profit driven, ahead of the curve on technologies or methods, and generally up for using a little imagination in getting things done.

Bas starts off by saying, “Tax law is intended to serve the greater good, but it has become extremely complex. Although, it can be a good news show if you choose to address it as such. So that's my motivator.” Besides that, he adds, “the people I can sit at the table with, they’re usually much more interesting than myself, and that's always good. Surprisingly, as a tax guy, I actually get to sit at those tables. Because tax is not complex, it's just obscure. And I took the time to dive in.”

The importance of employee incentives schemes

As a ‘tax guy’ Bas is a big fan of employee incentives schemes, and not only because the tax side of it is fascinating. He believes that these types of incentives help companies perform better. “Employee incentive schemes help with employee retention and motivation, and that’s not just my word. Research of the Harvard Business Review shows, companies perform a third better after implementing incentive plans perform than before.” Bas shares.

The only thing against it, he shares, “The set-up can be complex. I see many founders struggling with how to approach employee incentive schemes. There’s a lot of unclarity around the subject, and that's where we come in.”

The big 5 employee incentive schemes

As already spilled in the intro, when Bas talks about the big 5 he’s talking about the 5 different employee incentive schemes. Bas sees this as a ‘genome tree’, like you'd find in a zoology book. Under the big umbrella of incentive plans, there are two main subcategories: non equity based plans and equity based plans.

Non equity based plans

Non equity based plans, also called employee bonus plans, typically reward employees with cash rather than company stock. There are two different types of non equity based plans.

The first and most common incentive plan is the Key Performance Indicator (KPI) plan, where employees get rewarded with an additional cash payment when specific personal goals or KPIs are met. A rather individualistic approach, focussing mostly on the performance of the individual, not necessarily on the company' growth as a whole. A company downside can be that if such an individual milestone is hit, the bonus becomes payable per law while it doesn't automatically link to company cash position. So: maybe the cash isn't there, but the bonus is due…

The second non-equity plan is a virtual stock, also known as Stock Appreciation Right (SAR). SARs are linked to the company's stock price during a fixed period, and are profitable for employees when the company's stock price rises, similar to employee stock options. However, the benefit of stock appreciation rights are that employees can receive proceeds from stock price increases without having to buy stock.

Looking at the pro’s and con’s for non equity based plans, Bas points out that although these plans are super easy to implement, there is a downside. “From a tax perspective, this is not the friendliest regime! Because both of these plans are implemented through the employment contract and are on top of employment wage. Meaning an employee gets extra wage. And wage isn't tax super friendly, the Dutch top rate is 49.5%.”

Equity-based plans

This is where it becomes interesting, according to Bas. “Equity-based plans are complex, because you give actual stock away. It even involves a notary, as it’s not linked to the employment contract, and delves into a whole separate part of law.” Equity-based plans, in other words employee stock ownership plans (ESOPs), give employees shareholder interests, offering them to feel a sense of ownership. These come in threefold: stock options, depositary stock and company stock.

Stock options give the employee the right to buy underlying stocks at a predetermined price within a specific period of time.

Depository shares, also known as share certificates, are issued by a shareholder and grant the depositary owner all the economic rights whilst the legal rights remain with the shareholder. Bas explains that you effectively disconnect the cap table and control table. “The employees are on the cap table, but not on the control table. All the voting and meeting rights related to the underlying shares held by the employee are held by a foundation or trust.”

And finally, actual Company Stock, or as Bas calls it ‘The Ultimate Long Term Thing’. An employee with company stock receives full co-ownership of the company’s equity, is asked to attend the shareholder meetings and allowed to use its voting rights. Usually, this form of equity based incentives is only available to the management team and co-founders.

When asking Bas about the pro’s and cons of these three plans, he starts by sharing, “It’s important to understand that some people don’t really care for this approach. It’s not just about the money now, it’s about having a say and a feeling of ownership. Because you can’t pay your groceries with stocks, right?”

Besides that, it’s way more complex to implement, if you look at the tax side of equity plans. An equity-based plan has two main chapters: the grant or transfer, and the subsequent holding period. Holding equity is generally very tax friendly, as the proceeds are taxed under the capital gains regime. The rate here is much lower at a flat 31%, and the return is a deemed one rather than an actual one. That means the tax due is effectively flat, and especially when the company shows drastic growth, the effective rate can be very favourable. But: the preceding chapter is actually getting the equity to the employee, and that can be complicated. Any implicit or explicit discount granted on the equity transaction is itself taxed as wage, which is taxable at the 49.5% rate. This either means a big cash-out for the company through a gross-up wage tax, or with a tax push-down clause, for the employee getting the stock but needing to pay cash tax. Therefore, the transaction chapter often needs some design to avoid a discount upfront, such as a purchase price loan or a hurdle. It’s been done many times before, so you always figure it out and if you believe in long-term growth, the investment in such a plan is always rational. But implementing equity-based plans isn’t nearly as simple as implementing a bonus wage plan.

If you’re curious about more pros and cons regarding, check out this article that Bas wrote a little while back.

The Netherlands needs to become more equity incentive plan friendly

Bas explains that the complexity around the tax side of equity plan, involves more than just employees and scale-ups. “We’re a high wage, low resource country. Our government policy is geared towards being an exporter of intellectual property, the knowledge economy. And the shortage of highly educated people is a big bottleneck for the Dutch economy. Something a lot of companies overcome by raising salaries or bonuses. But sadly, most scale-ups just don’t have the cash to give their employees a higher salary or a bonus.”

The reason, the whole scale-up industry, is lobbying for the Netherlands to become a bit more equity incentive plan friendly. “But until that moment, this is what we have to work with. And we always make it work” Bas adds.

Final piece of advice

If we haven’t scared you off, hopefully we didn’t, because employee incentive plans are a great way to increase your employee's contentment and your company performance. For those companies that are at the beginning of setting up their employee incentive plans, Bas has a few valuable steps:

What type of incentives would employees value the most?

Start by asking your employees what type of incentives they value the most, what would incentivize them? Cash? Ownership?

What are you willing to give away?

After finding out what your employees value the most, it’s good to think about what you are willing to give away. This might already eliminate a few options your employees gave you.

Forecast the cash flow and see is feasible

As explained earlier, it’s important to take a close look at your cash flow. For instance, if you would set up a non-equity based plan. You need to realise that when a milestone is hit, and the bonus becomes payable per law, it doesn't automatically link to your company cash position. Maybe the cash isn't there, but the bonus is due. So forecasting cashflows [simpler than it sounds] usually narrows it down further.

Compare the different options by making scenarios

Eventually, compare the different options that are still left, to decide which of those would work best for your situation. Give it some time to simmer, think up scenario’s, and see if you’re happy.

Make a thorough decision, you can only do it once

Compare the different options and set scenarios to find out what would work best – then implement and stick with it.

Always be open and visualise it

Last but not the least Bas mentions “The psychological effect of a raise, according to science, is only two weeks. Not even until the next pay check. Let’s say, if you’d give your employees stock appreciation rights, it takes a considerable amount of time to eventually cash out. If you don’t visualise that this person is hypothetically generating bonus potential, they will not know what they’re doing it for. And that really mitigates the aspect of incentive plans. By dashboarding the incentive plan, it is repeatedly visible, which makes a huge difference for its impact. Big tip!”

Want to learn more about Archipel Tax Advise’s journey and employee incentive plans? Listen to the full story on Spotify.

In this month's xCollective we’re discussing an exciting subject! Well, exciting for some, less for others. Nevertheless, a topic that occupies the minds of many founders. We’re going to talk about employee incentive plans and the different approaches you can take. Or the big five, as our guest Bas Jorissen, founding partner at Archipel Tax Advice, likes to call them.

“Apart from just a guy. I am a tax guy.”

Almost 5 years ago, Bas started Archipel Tax Advice, a tax advisory firm that helps the translation between real life and taxation. Their clients – fast-growing corporates & scale-ups – are typically more-than-profit driven, ahead of the curve on technologies or methods, and generally up for using a little imagination in getting things done.

Bas starts off by saying, “Tax law is intended to serve the greater good, but it has become extremely complex. Although, it can be a good news show if you choose to address it as such. So that's my motivator.” Besides that, he adds, “the people I can sit at the table with, they’re usually much more interesting than myself, and that's always good. Surprisingly, as a tax guy, I actually get to sit at those tables. Because tax is not complex, it's just obscure. And I took the time to dive in.”

The importance of employee incentives schemes

As a ‘tax guy’ Bas is a big fan of employee incentives schemes, and not only because the tax side of it is fascinating. He believes that these types of incentives help companies perform better. “Employee incentive schemes help with employee retention and motivation, and that’s not just my word. Research of the Harvard Business Review shows, companies perform a third better after implementing incentive plans perform than before.” Bas shares.

The only thing against it, he shares, “The set-up can be complex. I see many founders struggling with how to approach employee incentive schemes. There’s a lot of unclarity around the subject, and that's where we come in.”

The big 5 employee incentive schemes

As already spilled in the intro, when Bas talks about the big 5 he’s talking about the 5 different employee incentive schemes. Bas sees this as a ‘genome tree’, like you'd find in a zoology book. Under the big umbrella of incentive plans, there are two main subcategories: non equity based plans and equity based plans.

Non equity based plans

Non equity based plans, also called employee bonus plans, typically reward employees with cash rather than company stock. There are two different types of non equity based plans.

The first and most common incentive plan is the Key Performance Indicator (KPI) plan, where employees get rewarded with an additional cash payment when specific personal goals or KPIs are met. A rather individualistic approach, focussing mostly on the performance of the individual, not necessarily on the company' growth as a whole. A company downside can be that if such an individual milestone is hit, the bonus becomes payable per law while it doesn't automatically link to company cash position. So: maybe the cash isn't there, but the bonus is due…

The second non-equity plan is a virtual stock, also known as Stock Appreciation Right (SAR). SARs are linked to the company's stock price during a fixed period, and are profitable for employees when the company's stock price rises, similar to employee stock options. However, the benefit of stock appreciation rights are that employees can receive proceeds from stock price increases without having to buy stock.

Looking at the pro’s and con’s for non equity based plans, Bas points out that although these plans are super easy to implement, there is a downside. “From a tax perspective, this is not the friendliest regime! Because both of these plans are implemented through the employment contract and are on top of employment wage. Meaning an employee gets extra wage. And wage isn't tax super friendly, the Dutch top rate is 49.5%.”

Equity-based plans

This is where it becomes interesting, according to Bas. “Equity-based plans are complex, because you give actual stock away. It even involves a notary, as it’s not linked to the employment contract, and delves into a whole separate part of law.” Equity-based plans, in other words employee stock ownership plans (ESOPs), give employees shareholder interests, offering them to feel a sense of ownership. These come in threefold: stock options, depositary stock and company stock.

Stock options give the employee the right to buy underlying stocks at a predetermined price within a specific period of time.

Depository shares, also known as share certificates, are issued by a shareholder and grant the depositary owner all the economic rights whilst the legal rights remain with the shareholder. Bas explains that you effectively disconnect the cap table and control table. “The employees are on the cap table, but not on the control table. All the voting and meeting rights related to the underlying shares held by the employee are held by a foundation or trust.”

And finally, actual Company Stock, or as Bas calls it ‘The Ultimate Long Term Thing’. An employee with company stock receives full co-ownership of the company’s equity, is asked to attend the shareholder meetings and allowed to use its voting rights. Usually, this form of equity based incentives is only available to the management team and co-founders.

When asking Bas about the pro’s and cons of these three plans, he starts by sharing, “It’s important to understand that some people don’t really care for this approach. It’s not just about the money now, it’s about having a say and a feeling of ownership. Because you can’t pay your groceries with stocks, right?”

Besides that, it’s way more complex to implement, if you look at the tax side of equity plans. An equity-based plan has two main chapters: the grant or transfer, and the subsequent holding period. Holding equity is generally very tax friendly, as the proceeds are taxed under the capital gains regime. The rate here is much lower at a flat 31%, and the return is a deemed one rather than an actual one. That means the tax due is effectively flat, and especially when the company shows drastic growth, the effective rate can be very favourable. But: the preceding chapter is actually getting the equity to the employee, and that can be complicated. Any implicit or explicit discount granted on the equity transaction is itself taxed as wage, which is taxable at the 49.5% rate. This either means a big cash-out for the company through a gross-up wage tax, or with a tax push-down clause, for the employee getting the stock but needing to pay cash tax. Therefore, the transaction chapter often needs some design to avoid a discount upfront, such as a purchase price loan or a hurdle. It’s been done many times before, so you always figure it out and if you believe in long-term growth, the investment in such a plan is always rational. But implementing equity-based plans isn’t nearly as simple as implementing a bonus wage plan.

If you’re curious about more pros and cons regarding, check out this article that Bas wrote a little while back.

The Netherlands needs to become more equity incentive plan friendly

Bas explains that the complexity around the tax side of equity plan, involves more than just employees and scale-ups. “We’re a high wage, low resource country. Our government policy is geared towards being an exporter of intellectual property, the knowledge economy. And the shortage of highly educated people is a big bottleneck for the Dutch economy. Something a lot of companies overcome by raising salaries or bonuses. But sadly, most scale-ups just don’t have the cash to give their employees a higher salary or a bonus.”

The reason, the whole scale-up industry, is lobbying for the Netherlands to become a bit more equity incentive plan friendly. “But until that moment, this is what we have to work with. And we always make it work” Bas adds.

Final piece of advice

If we haven’t scared you off, hopefully we didn’t, because employee incentive plans are a great way to increase your employee's contentment and your company performance. For those companies that are at the beginning of setting up their employee incentive plans, Bas has a few valuable steps:

What type of incentives would employees value the most?

Start by asking your employees what type of incentives they value the most, what would incentivize them? Cash? Ownership?

What are you willing to give away?

After finding out what your employees value the most, it’s good to think about what you are willing to give away. This might already eliminate a few options your employees gave you.

Forecast the cash flow and see is feasible

As explained earlier, it’s important to take a close look at your cash flow. For instance, if you would set up a non-equity based plan. You need to realise that when a milestone is hit, and the bonus becomes payable per law, it doesn't automatically link to your company cash position. Maybe the cash isn't there, but the bonus is due. So forecasting cashflows [simpler than it sounds] usually narrows it down further.

Compare the different options by making scenarios

Eventually, compare the different options that are still left, to decide which of those would work best for your situation. Give it some time to simmer, think up scenario’s, and see if you’re happy.

Make a thorough decision, you can only do it once

Compare the different options and set scenarios to find out what would work best – then implement and stick with it.

Always be open and visualise it

Last but not the least Bas mentions “The psychological effect of a raise, according to science, is only two weeks. Not even until the next pay check. Let’s say, if you’d give your employees stock appreciation rights, it takes a considerable amount of time to eventually cash out. If you don’t visualise that this person is hypothetically generating bonus potential, they will not know what they’re doing it for. And that really mitigates the aspect of incentive plans. By dashboarding the incentive plan, it is repeatedly visible, which makes a huge difference for its impact. Big tip!”

Want to learn more about Archipel Tax Advise’s journey and employee incentive plans? Listen to the full story on Spotify.